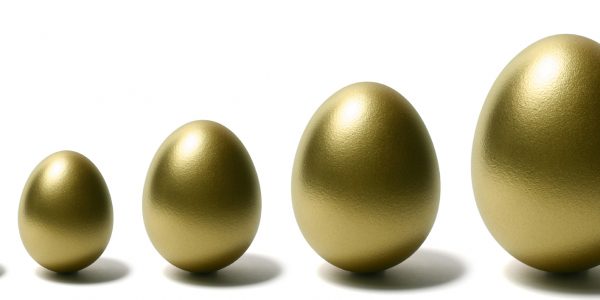

Give your money a head start with these five ways to make the most of your wealth in 2015, presented by UK wealth manager Tilney BestInvest.

Over the past few weeks many of us have been putting time and effort into our New Year’s Resolutions – from spending more time in the gym to cutting out bad habits and taking up new hobbies. But with 2015 well underway and the end of the tax year now fast approaching, now is also a great time to make sure your finances are in order. With this in mind, here are five ways to make the most of your wealth in 2015.

1. Get help from a professional

If you don’t have the time or confidence to handle your finances, or you have more complex financial needs, you are far more likely to meet your objectives with the help of a wealth manager.

![]()

In the same way that a personal trainer will give you a workout plan for your fitness goals, a wealth manager can create a bespoke strategy that is tailored to your financial and lifestyle goals.

They can help you with everything on this list too – but, alas, not with burning off those extra calories.

2. Don’t miss important deadlines

31 January is the deadline for completing and sending your tax return. This can be a long and complicated process, but you will be penalised by HMRC for a late or incorrect submission. 5 April is another important date, as it is the end of the tax year and the last day to make use of your ISA and pension contribution allowances for 2014/15. A good wealth manager will keep an eye on these key deadlines and make sure your financial affairs are settled in light of them.

3. Make use of your annual allowances

There is no tax to pay on investments held within an ISA (except you cannot reclaim the tax credit on dividends), and this year’s annual allowance is £15,000. However, ISA allowances do not carry over between tax years, so if you don’t use your limit by 5 April you’ll miss out on valuable tax relief. You also get tax relief on pension contributions – HMRC tops up your contribution by 20%, and higher or additional rate taxpayers can claim back a further 20% or 25% through their tax returns. You don’t usually get tax relief on anything in excess of your annual earnings, but under pension ‘carry forward’ rules you could potentially make tax-efficient contributions of up to £190,000 this year.

4. Consolidate your investments

It’s easy to collect a number of different pensions by switching jobs several times throughout your working career, and it’s also not uncommon to have several savings and investment accounts. Managing your finances with a single provider can give you a clear picture of your overall wealth, and helps you keep track of how your investments are currently performing. Consolidating could also help to cut down on fees that can eat into your returns over the long term.

5. Set up regular savings

Set up regular savings now and you could reap the benefits all year. Investing a lump sum commits all your money to the market at the same time and the same price, whereas drip-feeding your money over a longer period can help to smooth out market highs and lows. This is because when prices are low your money buys more units or shares, and when they rise you get less – something called ‘pound cost averaging’.

If you would like help with anything in this article, or want to discuss your wider financial requirements, you can book a free consultation with one of Tilney Bestinvest’s local wealth managers today.

Important information

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested.

Prevailing tax rates and reliefs are dependent on your individual circumstances and are subject to change. Before you consider transferring a pension, it is important to ask yourself: Will I lose any valuable benefits or features from my existing pension plan? Will I incur any penalties on my existing pension if I transfer? Is it an occupational final salary pension scheme? (in which case it is very unlikely to be advisable to transfer) Have I considered the charges on my current plan? (a new arrangement may be more expensive – especially if you have a stakeholder pension). Please note we do not provide tax advice. This article is not a personal recommendation or advice to invest.