Diversifying your investments properly requires a global view, which also means that mitigating the impact that currency fluctuations can have on your returns is key. Here, Simon McConnell, senior portfolio manager at Netwealth, explains how the different currency hedging techniques you can deploy work.

When building portfolios, naturally the proportions we invest in each asset class is key, and we also consider factors such as currency hedging – but what impact can different hedging approaches have on investment portfolios?

Currency hedging can help to minimise the risks associated with exchange rate movements. For example, the exchange rate between the US dollar and the Japanese yen will fluctuate daily, as will the exchange rate between the euro and sterling, and practically between every currency in the world.

When we experience outsized exchange rate fluctuations, it can have a material impact on investment portfolios. Therefore, investors such as Netwealth seek to mitigate these effects by implementing their own approach to currency hedging.

Generally, there are three possible hedging approaches:

1. Do nothing (portfolio is fully unhedged)

The total return on an international asset is composed of the local return – its performance in its home country – and the foreign exchange (FX) return. For example, consider a UK investor using sterling and buying a US equity ETF which tracks the S&P 500 Index.

Let’s say they invest $100 when the US dollar to pound sterling FX rate was $1.25 (£1 buys $1.25). Over the investment period, if the dollar price of the ETF trades up to $114 and the exchange rate moves to $1.50, the total effect on the portfolio in GBP (sterling) terms is a loss of £4.

The total return on an international asset is composed of the local return – its performance in its home country – and the foreign exchange (FX) return

For those interested in the calculations we can show how this loss was realised:

– At the start, market value = $100, or £80

– At the end, market value = $114, or £76

– Total return = (1 + local asset return %) * (foreign exchange profit/loss) -1

The total return in dollars equals $14 (or +14%), but in GBP terms this equates to a loss of £4, (or -5%) due to the movements in the exchange rate.

2. Hedge all currency risk

Generally, investors that choose to hedge will do so either because:

– They believe the international currency will weaken versus their domestic currency; or

– They do not wish to endure the added volatility of currency markets.

In this instance, the investor uses derivative contracts (so-called currency forwards) to offset exchange rate fluctuations embedded in the first example. There is a cost to hedging, which is driven by the interest rate differentials between the two currencies.

There is a cost to hedging, which is driven by the interest rate differentials between the two currencies

Hedging Return = ((1 + Domestic Interest Rate)) / ((1+ Foreign Interest Rate)) -1

So, continuing the example above, if we assume the Bank of England’s Bank Rate was 4% and the US Federal Funds Rate was 6% (and expected to stay constant), the total effect on the portfolio in GBP terms is a gain of £11.85.

We can show how this gain was realised:

– Total return = (1 + local asset return %) * (1+ hedging return) -1

– Which equates to (1 + 14%) * ((1+4%) / (1+6%)) – 1 = +11.85%

Therefore, the impact of hedging is a lower return than in local (US dollar) terms ($14 as before), but greater than the unhedged return (which was a loss of £4).

Top Tip

As a former currencies trader, hedging techniques is a subject close to my heart – it is also an area of risk mitigation that is all too often completed neglected by DIY investors.

As this piece illustrates, there are several options to consider and the right approach will very much depend on the make-up of your particular portfolio. Currency hedging really is a topic where expert advice is required. This can make a real difference to your returns and risk exposures, so why not let us set up some no-obligation discussions with leading wealth managers who can help?

Lee Goggin

Co-Founder

3. Take an active decision to currency hedging – the Netwealth approach

We consider currency risk on an independent basis from the underlying asset exposures for all international investments. We aim to ensure that overall portfolio returns are not dominated by unintended currency movements – and benefit instead from considered management to deliver better risk-adjusted returns than both a naïve fully hedged or fully unhedged approach.

In particular, from a sterling investor standpoint, we think there are strategic benefits to owning US and Japanese assets on an unhedged basis as those currencies often tend to strengthen during downturns. In other words, we like their counter-cyclical properties and the diversification benefits they bring to portfolios.

The opposite is true for investments in euro dominated assets, where our decision to fully hedge has been rewarded. Finally, we invest in emerging market assets on an unhedged basis – there are structural reasons why EM currencies appreciate over the long-term, and due to their relatively higher interest rates, the cost of hedging can be punitive.

In particular, from a sterling investor standpoint, we think there are strategic benefits to owning US and Japanese assets on an unhedged basis as those currencies often tend to strengthen during downturns

Additionally, we may choose to alter our currency positioning on a cyclical basis, too. These decisions can be driven by factors such as:

- extreme valuations

- the relative macroeconomic outlook

- the mispricing of relative monetary policy paths

- more attractive yield or carry (the cost of hedging), in either the home currency or internationally

- idiosyncratic risks

For example, in the very early years of the Netwealth portfolios, we maintained a lower-than-normal position in sterling, due to what we perceived was a mispricing surrounding the Brexit referendum. This benefited investment returns as sterling weakened sharply.

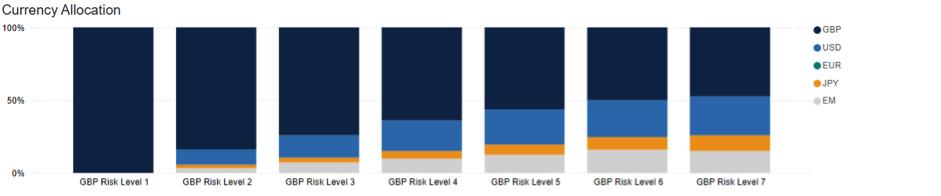

Our current currency allocations across our portfolios

We maintain an overweight position in the US dollar against the Japanese yen via a Japanese equity hedged to USD ETF. There are several structural reasons why the yen might continue its weakness, despite recent intervention. The large current interest rate differentials between Japan and the US means that the cost of hedging (the carry) is extremely favourable.

We maintain an overweight position in the US dollar against the Japanese yen via a Japanese equity hedged to USD ETF. There are several structural reasons why the yen might continue its weakness, despite recent intervention

We maintain strategic allocations elsewhere, too. This means we have exposure to emerging market currencies from equity and fixed income holdings, but zero allocations to the euro on our GBP portfolios.

Important information

The investment strategy and financial planning explanations of this piece are for informational purposes only, may represent only one view, and are not intended in any way as financial or investment advice. Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment and financial planning decisions.

Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.