Graham Andrade, Partner at London-based Partners Wealth Management, explains what High Net Worth Individuals should know about Inheritance Tax – and its mitigation through commonly used wealth management techniques.

Arguably the British public’s most unpopular tax, Inheritance Tax (IHT) is yet again in the spotlight following the Chancellor’s decision to freeze IHT thresholds for a further two years until April 2028 as part of the Autumn Budget. Extending the frozen thresholds exacerbates the problem of rising house prices and high inflation, meaning more estates could be affected.

In the current environment, marked by rising interest rates and high inflation, it is more important than ever to make sure you have developed the most optimal way to manage your taxes. And with the regulatory landscape always evolving, it might not be easy to do so on your own.

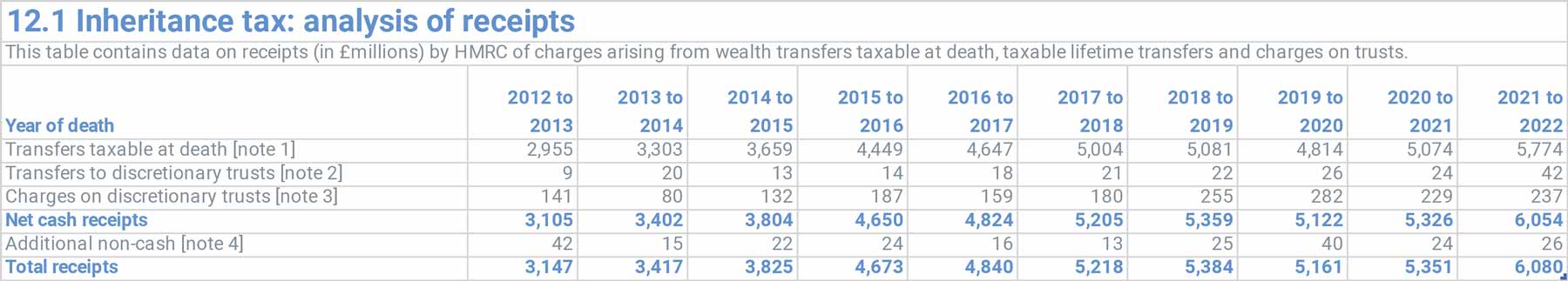

IHT receipts on an upwards trend

According to the HM Revenue and Customs (HMRC), total receipts for April 2022 to January 2023 stood at £5.9bn, a £900m increase from the figure for the same period the previous yearThe Office for Budget Responsibility (OBR) has forecasted receipts for 2022-2023 will total £6.7bn, equivalent to 0.7% of all receipts and representing 0.3% of national income2. To put the IHT receipts upwards trend in perspective, 10 years ago the total receipts for 2012-13 were just a little more than £3bn.

A reminder of the thresholds

In 2017 the government introduced an additional nil-rate band when a residence is passed on death to a direct descendant. When added to the existing threshold of £325,000, the main residence nil-band of £175,000 could potentially increase the overall allowance to £500,000 for individuals and £1m for couplesIn 2017 the government introduced an additional nil-rate band when a residence is passed on death to a direct descendant. When added to the existing threshold of £325,000, the main residence nil-band of £175,000 could potentially increase the overall allowance to £500,000 for individuals and £1m for couples. However, even if a home is left to direct descendants, if the value is over the £2m taper threshold, the main residence nil-rate band will taper away by £1 for every £2.

Top Tip

Inheritance Tax is indeed a hated tax – and it is little wonder considering that money would have been taxed several times over by the time it is taxed on death. A substantial proportion of our users have reducing IHT as one their concerns, with retirees of course prominent, yet don’t presume that this is solely something older people are thinking about. We’re increasingly hearing quite young parents thinking ahead in this way.

If reducing IHT – or indeed any tax bill – is front of mind for you, get in touch or take our short wealth manager matching questionnaire.

Lee Goggin

Co-Founder

Gifting for IHT

Understandably, most people will aim to take advantage of the means available to mitigate IHT. But doing so requires making sure you have sufficient funds during retirement, as well as reducing your IHT liability.

The first step for many people is to consider giving assets away during their lifetime. Some gifts will be automatically free from IHT; for example, an annual allowance of £3,000 each financial year, small gifts of up to £250, certain wedding gifts and gifts to charities or political parties. If you have surplus income, you can also make habitual gifts provided this does not demonstrably impact your standard of living. It is important to record all gifts.

If a gift is above the particular allowance, it will be caught by the seven-year gifting rule and will use all or part of an individual’s £325,000 allowance.

Other ways of planning for IHT

Of course, some individuals might not be able to afford to make gifts. Another option is to consider setting up a life assurance policy held in trust and payable on second death as a way of providing the executors with sufficient funds pay the IHT.

In general, IHT is payable at a rate of 40% on the residual estate after gifts, allowances and reliefs are taken into account. However, if you leave 10% to charities in your will, the overall rate can reduce to 36% and all gifts to charities in a will are free of IHT

In general, IHT is payable at a rate of 40% on the residual estate after gifts, allowances and reliefs are taken into account. However, if you leave 10% to charities in your will, the overall rate can reduce to 36% and all gifts to charities in a will are free of IHT.

Business Relief

You can get 100% Business Relief on:

- shares in an unlisted company.

- a business or interest in a business.

- shares controlling more than 50% of the voting rights in a listed company

- land, buildings or machinery owned by the deceased and used in a business they were a partner in or controlled

- land, buildings or machinery used in the business and held in a trust that it has the right to benefit from.

Agricultural Property Relief

100% relief applies:

- if you have vacant possession of the property because you occupy it yourself or you have a right to vacant possession within 12 months under the terms of any lease or licence

- if the land is let and the tenancy started on or after 1 September 1995

- by concession: if the land is let and certain conditions are met as to vacant possession

- under special rules for land let before 10 March 1981 and on the surrender and re-grant of pre-1 September 1995 protected tenancies.

Trusts can help you retain some control

Trusts can be ‘absolute’ (with named beneficiaries) or ‘discretionary’ (the trustees have flexibility and control over how best to use the trust assets for the benefit of the beneficiaries)There are various trusts, and each trust operates and is taxed differently. Trusts can be ‘absolute’ (with named beneficiaries) or discretionary’ (the trustees have flexibility and control over how best to use the trust assets for the benefit of the beneficiaries). The making of a gift to an individual or a trust must be without reservation (the settlor of the trust cannot benefit from the asset). However, there are ways in which capital or income can be returned to the settlor via a trust:

- Gift and Loan Trust – the original capital can be returned

- Reversionary Trust – there is an option to receive capital periodically

- Discounted Gift trust – provides income to the settlor.

Rely on expert advice

Planning IHT and using trusts are complex activities, requiring specialist advice. Our expert advice aims at significantly reducing the amount of tax your estate will need to pay, which means ultimately more of your wealth is passed to your beneficiaries. If you have queries or would like to discuss any aspect of IHT or estate planning, including the steps you can take now to reduce the amount of IHT due, please don’t hesitate to get in touch.

2 OBR

https://obr.uk/forecasts-in-depth/tax-by-tax-spend-by-spend/inheritance-tax/

https://www.gov.uk/inheritance-tax/gifts#:~:text=The%207%20year%20rule,on%20when%20you%20gave%20it

https://www.gov.uk/business-relief-inheritance-tax/what-qualifies-for-business-relief

https://www.lawsociety.org.uk/public/for-public-visitors/common-legal-issues/trusts

https://www.gov.uk/trusts-taxes/types-of-trust

Important information

The contents of the article have been prepared solely for information purposes. The article contains information on financial products and services and such information is designed for and addressed solely to individuals seeking generic industry information. Past performance is no guide to future returns. The above content does not represent a personal recommendation. Taxation will depend on your individual circumstances and may be subject to change.