Edward Allen, Private Clients Investment Director at Tyndall Investment Management, explains some alternative sources of yield investors can explore, such as investment trusts.

I am a private client investment manager, and it is my pleasure and privilege to speak to individuals about their personal finances. Yield on investments is a reoccurring theme of these discussions, the income environment having changed radically over the last two decades.

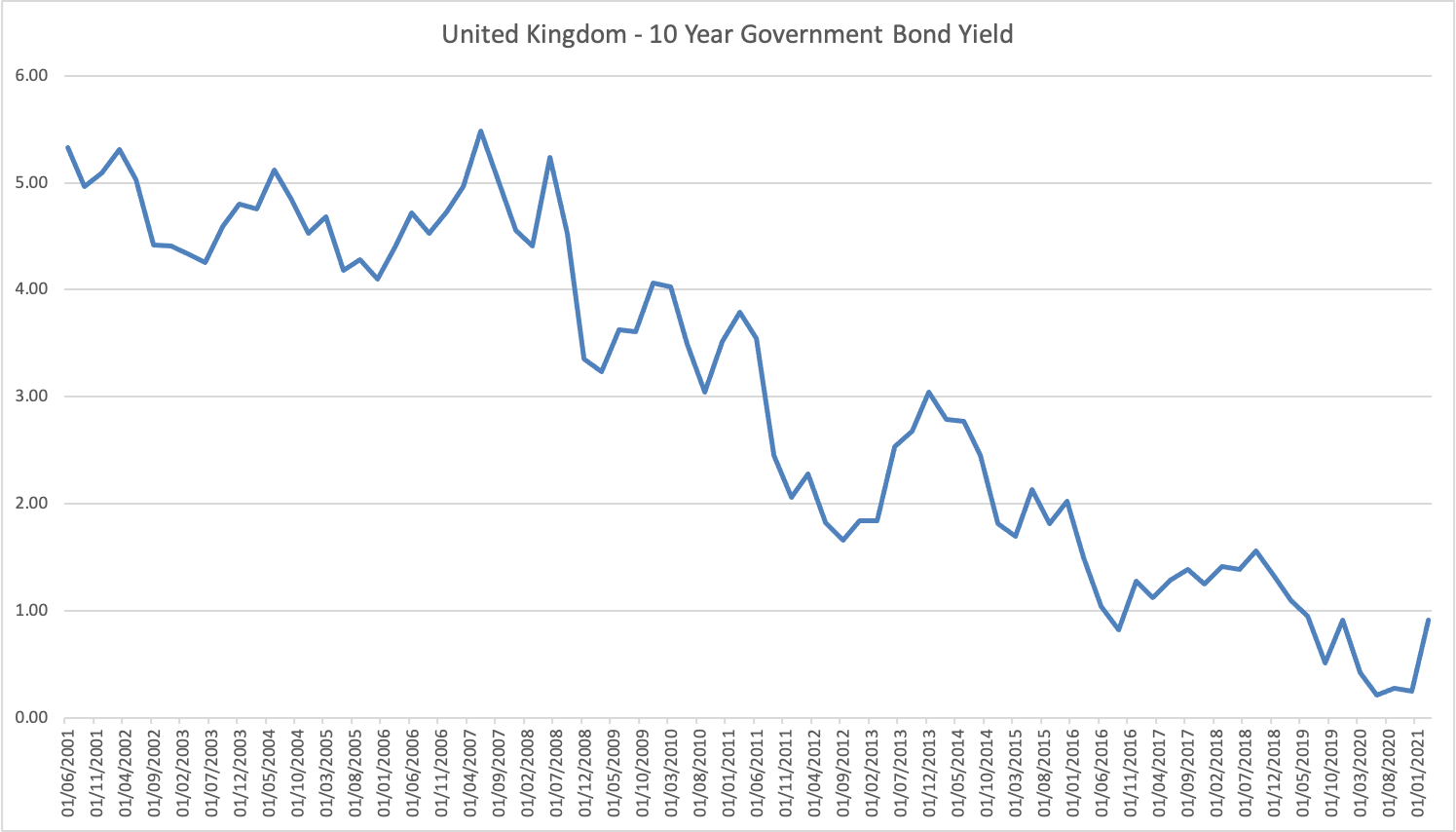

When I started my career in finance, Gilts (UK Government Bonds, called Gilts because certificates of ownership were traditionally edged with gold or “Gilt Edged”) yielded over 5% and were the mainstay of income investing. When I talk to clients about Gilts today, the prospect of locking up their hard-earned capital for ten years at 1% is, to put it politely, unattractive!

Chart source: Factset, 28/5/2021

In this day and age, we are obliged to be more creative when it comes to yield investing if we want to beat inflation, and there are plenty of options, some tried and tested, and some new to the market.

Tried and tested

Starting with “tried and tested”, the obvious income candidate is equities. The UK market yield quoted today is 2.9% (source: Bloomberg) and this will likely increase as dividends cut in the Covid crisis are reinstated. Specialist income funds may achieve more; our own Tyndall Real Income fund expects its companies to increase dividends by circa 30% in the coming year.

Alternatively, we can invest in individual stocks operating in a wide range of industries and geographic markets, from Commodities (Rio Tinto, current price 60.4p, 12 month trailing income yield 6.8%) to financial services (Legal & General, current price 2.87, 12 month trailing income yield 6.1%) to supermarkets (WM Morrison, current price 1.78, 12 month trailing income yield 6.3%). The flaw in this plan is that both dividends and capital values are risky.

In 2020, UK market dividends paid fell by -44%, in absolute terms falling to 2011 levels, and I do not need to tell you, dear reader, how volatile individual stocks or even market indices are.

Top Tip

We’ve heard from many disappointed income investors in recent times and though it may seem difficult to see alternative safe havens for your wealth we’ve been able to help great numbers of people pivot successfully to a new investment reality. Why not let us set up some initial conversations fast and free so that you can check your investment strategy is on the right track?

Lee Goggin

Co-Founder

Infrastructure

For a less volatile route to income investing, I use listed Infrastructure investment trusts.

Here in the UK, we are blessed with an excellent range of options, with income yields normally in excess of 4%. International Public Partnerships (INPP), run by Amber Infrastructure, currently yields 4.4% and has a level of inflation protection embedded in their contractual cashflows. It invests in a wide range of infrastructure projects in the UK and overseas, from gas pipelines to schools to military housing.

For a less volatile route to income investing, I use listed Infrastructure investment trusts

One of the largest and high profile of its projects is the Thames Tideway London sewage and waste-water tunnel, a “25km long, 7.2m diameter tunnel running up to 65 metres below the river Thames”. INPP own 16% of this project and have negotiated an inflation-linked income on its investment in both construction and operation phasesi.

Infrastructure investment trusts have been around since the mid-noughties, and most have delivered consistent income growth over that period. The investment trust structure shields the trusts’ capital from the whims of investor demand (or lack of it) and is therefore an appropriate way of holding what are, fundamentally, illiquid assets.

However, the market price for those trusts can move to either premia or discounts to their stated value, and this introduces volatility. In the most unpleasant of markets, as investors dash for the security of cash, discounts can widen dramatically, as happened in March 2020 when many trusts moved from premia of 10% or more to discounts of -10% or more… i.e. a share price fall of over 20%. For the canny investor, this represented an extremely attractive buying opportunity, but it would be wrong to suggest that these are low-risk investments, or that they are “uncorrelated” with equity markets.

For the canny investor, this represented an extremely attractive buying opportunity, but it would be wrong to suggest that these are low-risk investments, or that they are “uncorrelated” with equity markets

Commercial property

The same can be said of commercial property held via investment trusts, where again the UK has an impressive range of options listed on the stock exchange. Yields tend to be a little lower, and I have to admit that I have minimal exposure; I fear that the consequences of the covid crisis will have long-lasting impacts on the way that we use commercial and office space. I do have some exposure to logistics “sheds” serving the likes of Amazon and the supermarket chains but cannot work up any great enthusiasm for commercial property in general. A former colleague of mine bust the myth that property provides inflation protection; property degrades over time and so owners of property need to spend money on maintenance and repair or see the value of their property fall.

A former colleague of mine bust the myth that property provides inflation protection; property degrades over time and so owners of property need to spend money on maintenance and repair or see the value of their property fall

There are, however, an exciting array of niche listed investment trusts which provide attractive yields and a variety of underlying exposures. Energy storage, shipping, music royalties, high yield bonds… the list goes on and I am getting dangerously close to my word count limit! Suffice to say that higher, and often inflation protected yields are available in the UK market, although (to state the obvious) to achieve higher yields that the paltry 1% available on government bonds, a level capital risk must be accepted.

Important information

The investment strategy and financial planning explanations of this piece are for informational purposes only, may represent only one view, and are not intended in any way as financial or investment advice. Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment and financial planning decisions.

Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.