This month:

Expert investment views:

A compelling case is made for simply “sitting tight”, rather than fleeing markets in fear (or trying to time them)

Investors are urged to pay more attention to currency risk in a world of shifting currency “safe havens”

Cautionary words are offered for those who may have become used to easily-won returns from passive investments

A comforting note is sounded on inflation – although the next few years may feel uncomfortable for some

Featuring this month’s experts:

1. The benefits of sitting tight

Daniel Kahneman wrote: “nothing in life is as important as you think it is while you are thinking about it.” These are challenging times for investors. When our fears reach a crescendo and our fight or flight instinct takes over the easy thing to do is sell; staying the course is very hard to do in the face of an always uncertain future. Yet good assets can only provide compound returns if we allow time to work its magic.

It is hard to do nothing, but if you have selected your companies well and believe in their true ability to generate attractive returns on a persistent basis, then doing nothing makes sense.

It is hard to do nothing, but if you have selected your companies well and believe in their true ability to generate attractive returns on a persistent basis, then doing nothing makes sense

Putting this approach in some historical perspective. Since the trough of the market in March 2009, during the financial crisis, the MSCI All World Index has returned 14.8% per annum to 31/03/22 in sterling terms – enough to turn £1 million into £6m. During that time, we have endured peak to trough declines of more than 20% on three separate occasions and all for very different, largely unpredictable reasons. Unfortunately, such attractive long-term returns are only achieved by accepting significant volatility over shorter periods of time.

Missing the ten best days in any decade can lead to significantly lower returns than if we hold on and ride out the harder times. In fact, between 1990 and 2022 a compound annual return of 8.3% falls to -4% if the 90 best days are missed. The very worst periods are always followed by the very best. The key takeaway? Trying to time markets is a dangerous game.

Mark Leach

Partner and Portfolio Manager at James Hambro & Partners

2. Will US dollars continue to dominate?

The use of US dollars as the currency of choice is uncontroversial – at least for the West. An example of the greenback’s dominance can be seen in the world’s total foreign exchange reserves given it accounts for about 60%. Euros (its nearest rival) account for some 20%, while other currencies’ holdings are in single digit percentages globally. But the key question is: will the US dollar continue to dominate?

It is worth noting that US dollar reserves have dropped in percentage terms over the last 25 years and are likely to fall further following Russia’s invasion of Ukraine in February 2022. Russia had switched assets into other currencies and gold, to reduce its US dollar reserves, but struggled. This allowed the US and its allies to freeze roughly half of Russia’s central bank reserves of almost US$630 billion.

In this particular race, China’s renminbi might have the best prospects, but it is only really a longer-term prospect given the country’s capital controls. As a result, the US dollar will continue to dominate for now, but the world has been put on watch

Although the March meeting of the Eurasian Economic Union (Russia, Armenia, Kazakhstan, Kyrgyzstan and Belarus) and their agreement on the need to develop a new international currency is worth noting, the main debates have been between the BRICS (Brazil, Russia, India, China and South Africa). They had previously pushed for the increased use of their national currencies, but these efforts are now stepping up – the India-Russia talks to reinstate a rupee-rouble ledger, for the first time since the Cold War ended, highlight this.

In this particular race, China’s renminbi might have the best prospects, but it is only really a longer-term prospect given the country’s capital controls. As a result, the US dollar will continue to dominate for now, but the world has been put on watch.

But what can investors do? While wealth managers state their portfolios are diversified, it’s worth digging into the detail and looking beyond countries, industry sectors, types of investments, and investment styles. Most don’t manage currency risk. We do. It is a crucial aspect of our risk management given the global reach of our strategies. It allows portfolios to perform regardless of the source of growth and should help in a world of shifting currency “safe havens”.

Rebecca Cretney

Investment Counsellor at Nedbank Private Wealth

Top Tip

Dangers to your investment portfolio may come in many forms and, as this month’s experts emphasise, currency risk, volatility and inflation really need to be front of mind now. If you are concerned about your risk exposure why not use our free and fast matching service to have some no-obligation discussions with leading wealth managers and start the process of putting your mind at rest?

Lee Goggin

Co-Founder

3. Why higher, more volatile inflation calls for active investing

The explosion in the popularity of passive investing is the logical result of four decades of falling inflation and interest rates.

During this low-inflation era, a passive approach made sense for many investors. After all, when the market is rising, tracking the performance of the index is a straightforward way to make money.

But markets are changing to a new regime of higher and more volatile inflation. In this environment, traditional assets – such as equities and bonds – are likely to suffer. And that’s particularly true today when the actions of central banks and, more recently, governments have driven these assets to excessively high valuations.

I am not saying that you should try to avoid the worst days – they are impossible to predict – or stay out of the market altogether. Rather, I am highlighting the importance of having an active portfolio specifically constructed to protect against this new market regime

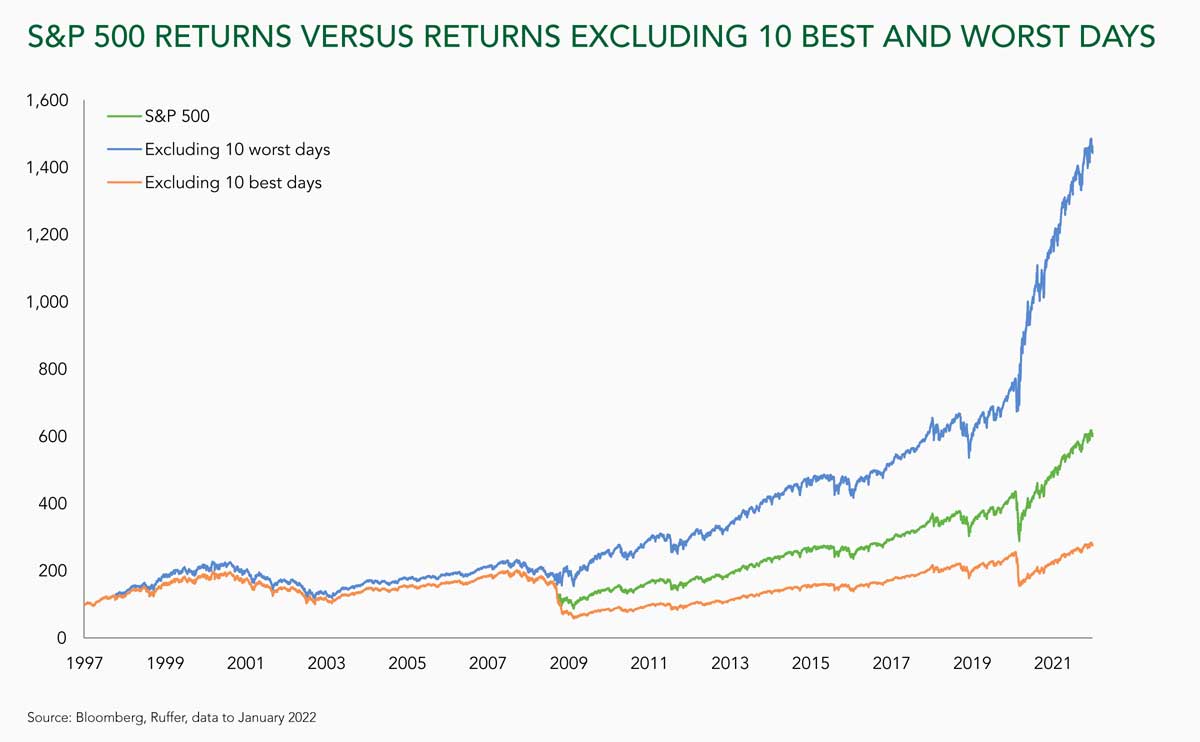

Fans of passive investing often point to a chart of past market performance. For the US S&P 500 Index over the last 25 years, this shows that, if you were out of the market on the ten best days, your overall return would have been only half that of the index. The fans’ message: hold on to your passive investment, and all will be well.

They are less keen to show you the chart of what happens when you are out of the market on the ten worst days. For the US market over the same period, your return would be more than double the market’s.

What’s more, the worst days have been getting worse – and are likely to get worse still in this new, inflationary environment.

I am not saying that you should try to avoid the worst days – they are impossible to predict – or stay out of the market altogether. Rather, I am highlighting the importance of having an active portfolio specifically constructed to protect against this new market regime.

Thomas Hardy

Investment Manager at Ruffer LLP

4. Rising interest rates: expect the expected

The news of the UK’s interest rate rising to 1% has grabbed attention. But headlines such as “UK raises rates to 13-year high!” are a bit misleading. Before 2009, 1% was the lowest rate of all time. Instead, all that has happened last week was that the Bank of England (BoE) has raised from ultra-low interest rates to ultra-low interest rates. That isn’t to say this isn’t important – but it isn’t quite the earth-shattering news it might appear.

We anticipate that interest rate hikes will continue, with base rates expected to sit at around 2.25% by March 2023. This is already reflected in the bond market, where global bond yields have risen significantly in the past six months. Further hikes from here shouldn’t be a surprise.

Inflation is set to fall, with the BoE forecasting that inflation will be close to its 2% target in “around two years”. But the journey will feel uncomfortable, as inflation is likely to hit 10% by the end of 2022 first, before coming back down

Inflation is set to fall, with the BoE forecasting that inflation will be close to its 2% target in “around two years”. But the journey will feel uncomfortable, as inflation is likely to hit 10% by the end of 2022 first, before coming back down.

We agree with the BoE’s assessment, that we are nearing the peak of the current inflationary rise. People are already baulking at higher prices. That slower spending will take the pressure off the sharpest price rise. The rest will be taken care of by central banks, which will continue to hike interest rates, taking inflation out the system.

Portfolios are where we want them to be. Both rising rates and higher inflation have been our base case for the couple of years. Whether it’s the direct underweight to bonds and the move to bond replacements, or the overweight to equities which aren’t negatively exposed to rising rates, our portfolios are prepared for what we expected to happen.

Ahmer Tirmizi

Senior Investment Strategist at 7IM

Important information

The investment strategy and financial planning explanations of this piece are for informational purposes only, may represent only one view, and are not intended in any way as financial or investment advice. Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment and financial planning decisions.

Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.