This month:

Expert investment views:

An appraisal is given of UK assets, which highlights how large-cap UK equities have ‘valuation on their side’

We are also urged to be on the look-out for equities opportunities more widely, as some are positioned to outperform amid inflation

A resurgence in robust bond returns makes one expert question rolling the dice on risk assets currently

Investors are reminded to think carefully about duration with Treasuries, however, with strong arguments seen for preferring the shorter end of the curve

Featuring this month’s experts:

1. Staying defensive in the UK

As the UK ushers in its third Prime Minister in 2022, investors will be hoping Rishi Sunak can bring some stability for investors in UK assets. The brunt of the recent volatility has been felt in the currency and bond markets. In the wake of the Liz Truss’s failed mini-budget, gilt yields, particularly for longer-dated bonds, rose significantly (and prices fell), as international investors demanded a higher premium for lending to the UK government. This premium has reduced, as fiscal discipline has been reinstated under Jeremy Hunt as Chancellor.

The UK stock market, however, has been largely immune to these difficulties – and may even have benefited. While the S&P 500 is down 21% for the year to date, the MSCI UK is up 1%i. UK large caps have been helped by a significant weighting in energy companies, which have performed well on the back of rising energy prices, plus the generally defensive and international nature of the index. The majority of sales (around three-quarters) are sourced outside the UK, and, in many cases, have been flattered by the weakness of sterling. Where there has been weakness, it has been felt among the more domestically focused small and mid-cap UK companies.

Defensive areas such as healthcare, consumer staples and utilities are well-represented in the FTSE 100 and should be resilient even as the economy weakens

Can this tentative stability last? The UK is now on watch from international investors and cannot be seen to put a foot wrong. At the same time, the economy has a tough road ahead. The combination of rising interest rates and high inflation is likely to put a significant dent in household and corporate spending, with the Bank of England forecasting the longest recession since the 1920s. This is a difficult backdrop for UK companies reliant on domestic markets to make progress and we see volatility continuing among small and mid-cap stocks.

Nevertheless, the large energy companies should be supported by ongoing strength in commodities markets, as supply shortages and the war in Ukraine keep prices high. Defensive areas such as healthcare, consumer staples and utilities are well-represented in the FTSE 100 and should be resilient even as the economy weakens. Most of all, large cap UK equities have valuation on their side, looking attractively priced compared to many of their international peers.

Daniel Casali

Investment Strategist, Investment Management, at Evelyn Partners

2. What to do about inflation?

The last time we saw inflation this high was in the 1970s and 80s. At this time, gold and property along with newly introduced inflation-linked bonds acted as a store of value. Fast forward to 2022, the gold price is down in dollar terms, inflation-linked bonds have fallen dramatically and, while property has held up so far, it may be about to see a sharp correction.

The problem is two-fold, the dramatic rise in interest rates and the starting prices for these asset classes. If inflation continues at such levels, one may have to look elsewhere for inflation hedges.

In March 1981, when inflation was 12.7%, the first index-linked gilt was issued at RPI plus 2%. At the start of this year, a 10-year index linked gilt paid RPI less 2.9%. Since 1997, the Bank of England has been independent with a 2% inflation target and is now raising rates in an effort to counter inflation. The inflation-linked index is highly sensitive to interest rates resulting in the broad index-linked gilt tracker dropping over 30% this year.

If inflation remains a concern, following the selloff in wider equity markets, we may uncover further opportunities

Gold performed well in the 1970s, peaking in 1980. Subsequently, the price halved and did not exceed this peak until 2008. While gold is positive in sterling terms this year, it is down in dollar terms. The issue with viewing these assets as hedges against inflation is that high interest rates weigh on gold, due to increased cost of carry, and that mortgage rates will generally weigh on property prices.

If inflation remains a concern, following the selloff in wider equity markets, we may uncover further opportunities. However, a selective approach is vital. Low leverage on the balance sheet will reduce the impact of higher rates. This, combined with a business model where rising costs can be passed on to the next customer, may help selective equities to outperform.

Jonathan Marriott

Chief Investment Officer at LGT

Top Tip

Lee Goggin

Co-Founder

3. It’s not just prices falling, it’s expected returns rising

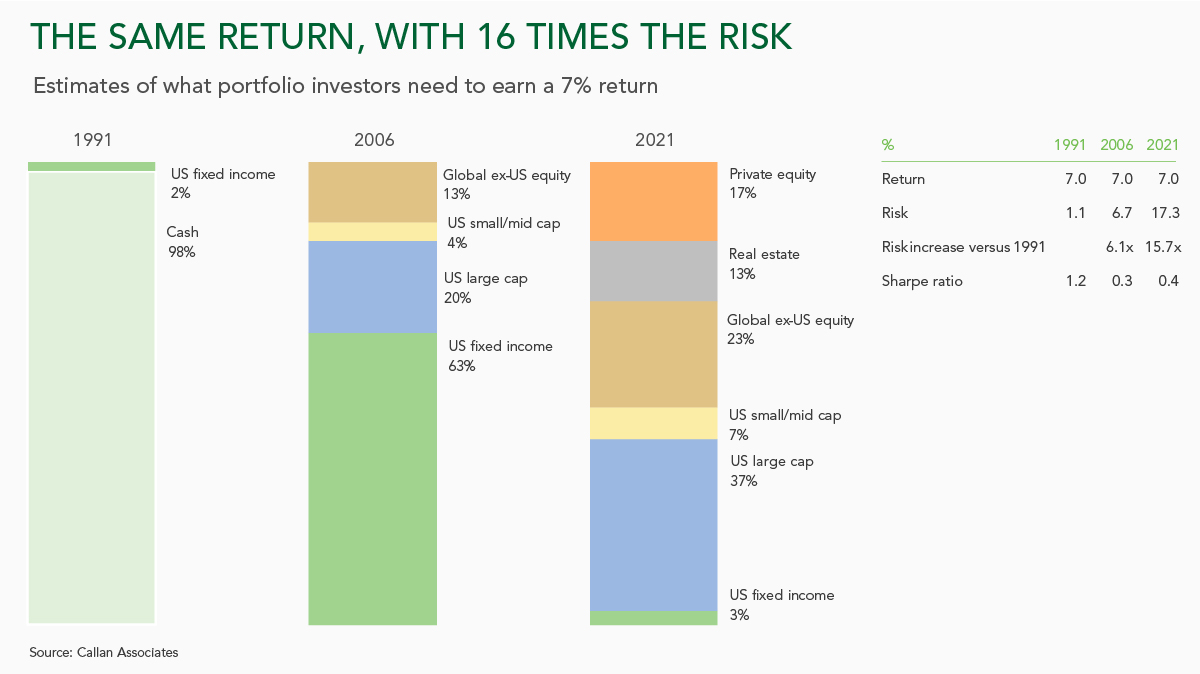

Forty years of declining inflation and bond yields – with the kicker of quantitative easing since 2008 – have driven investors to take ever more risk and accept ever greater illiquidity in portfolios for the same rate of expected return. A rate they often haven’t achieved in practice.

In 1991, US investors could earn 7% on a portfolio composed of 98% cash. Fifteen years later, they would have had to hold nearly two thirds in US fixed income, with the remainder in mostly mainstream equities. By 2021, 97% of the portfolio would have had to be invested in risk assets – a sizeable chunk of them very risky and illiquid – to stand a chance of earning 7%. (As it turns out, the portfolio would have come in well below that target.) Naturally, this also came with much more volatility and therefore a lower Sharpe ratio.

A year ago, the yield on a US two-year treasury was just 25 basis points. Now, the yield is back up to around 4%. And you can get higher yields still in corporate bonds (~5%) and high yield debt (~9%)

As we know, 2022 is becoming an annus horribilis for traditional multi-asset portfolios, as bonds and equities have fallen in tandem.

But think positively: it’s not just prices falling, it’s expected returns rising! A year ago, the yield on a US two-year treasury was just 25 basis points. Now, the yield is back up to around 4%. And you can get higher yields still in corporate bonds (~5%) and high yield debt (~9%).

So, while we may not be quite back to 1991 interest rates for cash, bonds are becoming more attractive. For example, both US TIPS and UK index-linked gilts are now on positive real yields.

Against a backdrop of heightened geopolitical risk and looming recession, those yields look pretty tempting. Why roll the dice on risk assets if you don’t have to?

Thomas Hardy

Investment Manager at Ruffer LLP

4. Our preference for the short end of the Treasury yield curve

It feels we may well be closer to the bond market anticipating a slowdown from the Federal Reserve. Price action after Thursday’s US consumer price inflation print confirmed our thinking. Before the inflation release, market expectations for interest rates had extended further than the most hawkish Fed members’ September projection.

Although activity indicators are yet to deteriorate meaningfully, purchasing managers’ indices are turning down, with the housing sector coming most under pressure. While the labour market has maintained relative strength, and household consumption has held up due to high levels of savings, this cannot continue in perpetuity – particularly as real incomes continue to be squeezed.

The direction of travel would argue for more caution from the Fed going forward.

Because of high inflation real US incomes are falling

Source: Bloomberg

Our view is that there are strong arguments for preferring to own duration at the shorter end of the curve now.

➔ The valuation signal is compelling – with the 2-year to 30-year yield curve extremely inverted compared with history. Historically curves haven’t stayed inverted for long, since if there is a substantial slowing in economic growth, this would force the hand of central banks to loosen monetary policy, which would put downward pressure on the shorter end of the curve and we’d see curve steepening.

➔ Commentary from a number of Fed members has become more balanced about the outlook for rate hikes through 2023, which was echoed in the most recent statement. The Fed’s hawkish narrative is beginning to shift.

➔ Positioning in the short end of the curve is extremely underweight compared to its recent history, whereas it is at more neutral levels at the long end.

Hence, reallocating a portfolio’s fixed income exposure to the short-end of the yield curve enhances their defensive characteristics – however, it doesn’t diminish their expected return.

Simon McConnell

Senior Portfolio Manager at Netwealth Investments

Important information

The investment strategy and financial planning explanations of this piece are for informational purposes only, may represent only one view, and are not intended in any way as financial or investment advice. Any comment on specific securities should not be interpreted as investment research or advice, solicitation or recommendations to buy or sell a particular security.

We always advise consultation with a professional before making any investment and financial planning decisions.

Always remember that investing involves risk and the value of investments may fall as well as rise. Past performance should not be seen as a guarantee of future returns.