James Hoare is Managing Director at Enhance MPI, an aggregator of investment performance data from firms across the entire wealth management industry. Here, he reveals how the sector performed last year and indicates what investors should really expect to be achieving long term.

Firstly, how do you form your overview of the sector’s investment performance?

James: Enhance MPI is an independent provider of investment performance data. Like findaWEALTHMANAGER.com, our mission is to provide investors with transparency.

We compile our Managed Portfolio Indices from performance figures provided by over 50 private client investment firms. Importantly, we assess performance in line with the way each particular manager runs the money, rather than through cruder “risk buckets”, and we also present returns attained net of fees to ensure a level playing field.

What’s your assessment of sector’s investment performance in 2019?

James: Given the huge amount of geopolitical turmoil seen last year, I think many investment managers – and their clients – will have been pleasantly surprised on the performance front. Taking a sterling, medium-risk portfolio as a reference point, not one of the 50 plus institutions we assess turned in a negative performance for 2019.

Given the huge amount of geopolitical turmoil seen last year, I think many investment managers – and their clients – will have been pleasantly surprised on the performance front. Taking a sterling, medium-risk portfolio as a reference point, not one of the 50 plus institutions we assess turned in a negative performance for 2019

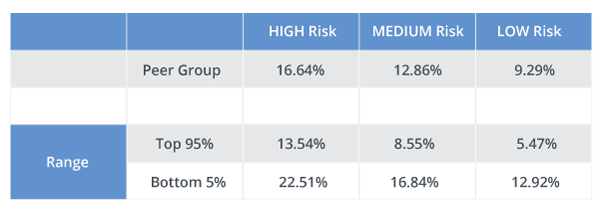

However, looking across the peer group, there was actually a surprisingly high level of dispersion in performance, especially in the first half of the year. It wasn’t substantially higher than we’ve seen previously, but certainly higher than one might expect given that “a rising tide raises all boats”. Most managers’ returns fell between 8% and 17% for the year, but we had some outliers either side of that as well.

2019 Wealth Manager Peer Group Averages and Ranges

(n=>50 investment managers)

What did the winners do differently, in your view?

James: Managers investing truly internationally of course did well in 2019, as did those who didn’t take the “risk-off” approach early in the year. Equities and bonds both did well into the middle of 2019, although equities became the place to be as the year drew to a close. That was a point of differentiation.

Managers investing truly internationally of course did well in 2019, as did those who didn’t take the “risk-off” approach early in the year

I think many were blindsided by the reversal of fortune in early 2019, and then paid the price for trimming back on equities too aggressively and buying shorter-dated bonds. That said, it’s fair to say that both the bulls and the bears have done relatively well this year: on a risk adjusted basis, both strategies have performed well.

Top Tip

It is important to examine investment performance, fees and service standards together to ensure the right mix for your needs. That said, wealth management is predicated on making your wealth work harder, so it’s good practice to keep monitoring your firm against its peers on returns. If you feel you could do better, see what other providers might serve you better through our free 3-minute search.

Lee Goggin

Co-Founder

What kind of start to the year have wealth managers made in their investment returns?

James: Our indices are quarterly, but we can provide monthly estimates. These indicate that while lower-risk portfolios appear to have performed well equities-led strategies have not fared so well in January 2020 across risk categories (we estimate low-risk portfolios +0.71%; medium-risk: +0.02% and high-risk -0.22%).

Speaking to managers there is nervousness about the effects, or the indirect effects, the Coronavirus will have on the global economy. It’s not just about the GDP effect it will have on China, particularly with all this happening around their New Year, but also the knock-on effects internationally.

On the flipside, I think people are looking forward to a potentially steadying effect from this being a US Election year. The consensus seems to be that President Trump is not going to want to upset the apple cart and China definitely does not want to escalate things on their side of the trade war now.

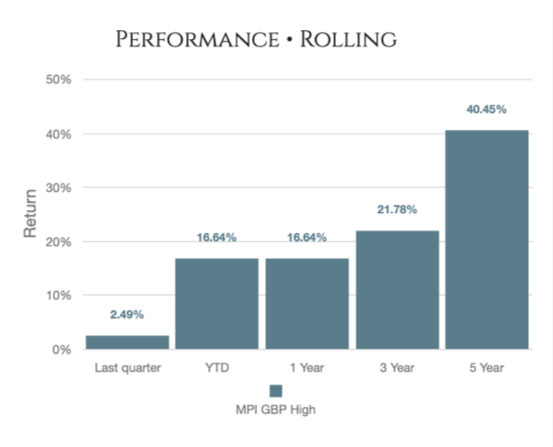

What level of investment returns should a typical wealth management client have been achieving over recent years?

James: Over the last five years, a sterling medium-risk portfolio has returned just under 5.5% per annum, after all the fees have been taken out. That level of returns has been readily achievable.

In the high-risk category performance has been closer to 7%, however between September 2018 and December 2018 the maximum “drawdown” or peak to trough loss averaged 8.65%, and in several cases exceeded 10%

In the high-risk category performance has been closer to 7%, however between September 2018 and December 2018 the maximum “drawdown” or peak to trough loss averaged 8.65%, and in several cases exceeded 10%. More adventurous strategies may have rewarded the bold in recent years, but you have to be able to stomach volatility like that and still sleep at night.